This post may contain affiliate links, meaning that if you click and make a purchase, I may earn a commission at no additional cost to you. Read the full disclosure here.

Last updated: February 21, 2025

A numéro fiscal is your unique number to use when filing taxes in France. There are a couple of different ways you can get a tax identification number (TIN). I acquired one quite easily as the spouse of a French citizen, so this blog post will detail how I accomplished that.

➡️ Quick tip, particularly for Americans: In France, your social security number (numéro de sécurité sociale) gives you access to the national healthcare program and your numéro fiscal de référence (also known as NIF—numéro d’identification fiscale) is used for taxes. Your social security number and your tax identification number are distinctly different and unrelated numbers.

Please note that this blog post is based on my personal experience and does not constitute legal advice. I cannot advise you on how to file your taxes. Please contact the French tax office or a tax professional if you have any questions regarding your specific tax situation. You can find contact information and resources at the end of this blog post.

Filing Joint Taxes in France

Generally speaking, if you are married or PACS’d and living together in France, you are required to file your taxes jointly. The year of your marriage or union, you can opt to file separately, but after that initial year, filing jointly becomes a requirement. A joint tax return is excellent proof toward your vie commune (life together) if you are applying for a carte de séjour “vie privée et familiale” or if you’re renewing your residence permit.

Filing taxes jointly is often beneficial because it means that your combined income will be considered together as a household (un foyer). If one partner is not working, which was the case for me in my first year in France, filing jointly might translate into a reduction in taxes owed.

Since my husband is a French citizen and already living, working, and paying taxes in France, he had already been assigned a numéro fiscal. There is an online portal for filing taxes. However, you can only file taxes online if you have a tax number. If one or both partners do not have this number, you will be unable to jointly file taxes online. In this case, for the initial declaration of joint taxes, the paper version needs to be filled out and mailed in with supporting documents.

⚠️ If you’re an American citizen, you might have a tax filing requirement for the United States as well!

How to Get Your French Tax Number

As the spouse of a French citizen, the easiest way to obtain your numéro fiscal is simply to file your joint taxes with supporting materials and leave the tax number portion blank. This process works whether or not you, as the spouse of the French citizen, have income to declare.

A second option is to formally request your French tax number ahead of the tax season, along with the required supporting documents. This process can be completed through your local tax office, known as SIP (Service des impôts des particuliers). Typically, you can either email them or present yourself in person so that they can verify your identity. The advantage of requesting your French tax number in this way is that you’ll be able to submit your tax declaration electronically.

⚠️ Note: Most local tax offices are no longer offering this service and may ask you to wait to file your taxes.

For our situation, the second option seemed like an unnecessary extra step, so we opted to simply fill out the joint tax form and leave the box for my numéro fiscal blank.

Documents Required

In order for the French tax administration to issue you a personal tax number, you need to prove that you have a fiscal obligation to France. After contacting the tax office to ask about requirements, these are the documents we submitted with our initial joint tax return in order for a tax number to be created for me as the spouse of a French citizen:

- acte de mariage (marriage certificate)

- make sure that it is recent; no older than 3 months is standard

- pièce d’identité (ID card) of the person needing the tax number

- this can be a copy of your passport/visa, carte de séjour, etc

- justificatif d’arrivée (proof of arrival)

- This can be proven in a number of ways. I included copies of all of the following items because I’m an overachiever 😉 (but one proof probably would have sufficed):

- visa validation confirmation (the PDF you receive after paying the tax online to validate your visa)

- OFII medical certificate

- tampon d’arrivée (arrival stamp in passport)

- This can be proven in a number of ways. I included copies of all of the following items because I’m an overachiever 😉 (but one proof probably would have sufficed):

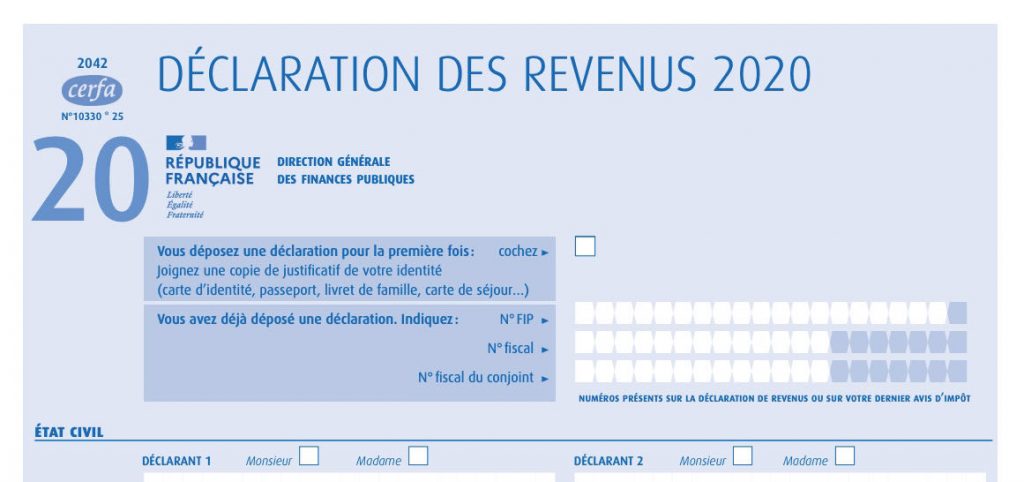

- Déclaration des revenus

- income & tax declaration document: Formulaire N°2042 (this form is updated every year, so be sure to wait and get the one for the year that you are filing)

- tick the ‘filing for the first time box’ at the top of the form

- leave the tax number box blank

- There is an online portal. When we filed for the first time (2020), there was no way for us to file joint taxes electronically unless we both had our tax numbers

We mailed everything together by lettre recommandée avec accusé de réception. This is the option that needs to be signed for upon arrival, and then you get a receipt in the mail notifying you that it arrived at the destination.

French Tax Deadline

Tax filing for 2025 begins in April.

Taxes are due on different dates depending on where you live in France (in which department) and how you are filing (electronically or by paper).

When you file taxes electronically, the deadline is based on your department. Typically the deadlines are between the end of May and the beginning of June.

When you file a paper tax return, regardless of where you live, it is due on the same date throughout France usually around mid May. As you can see, this is slightly earlier than what is typical, so make sure you pay attention to this detail!

Since we submitted a paper copy, we sent it by lettre recommandée avec accusé de réception to ensure that we would have a receipt regarding its arrival. Typically, letters like this only take a couple of days to arrive. We filed by mid-May 2020.

Receiving Your Numéro Fiscal

According to the tax person we spoke with to learn about this process, we should have received my tax number by mail but it never did arrive. Some people have noted receiving their French tax number by email. Jonathan ended up calling just a couple of months later, and they gave him my numéro fiscal over the phone.

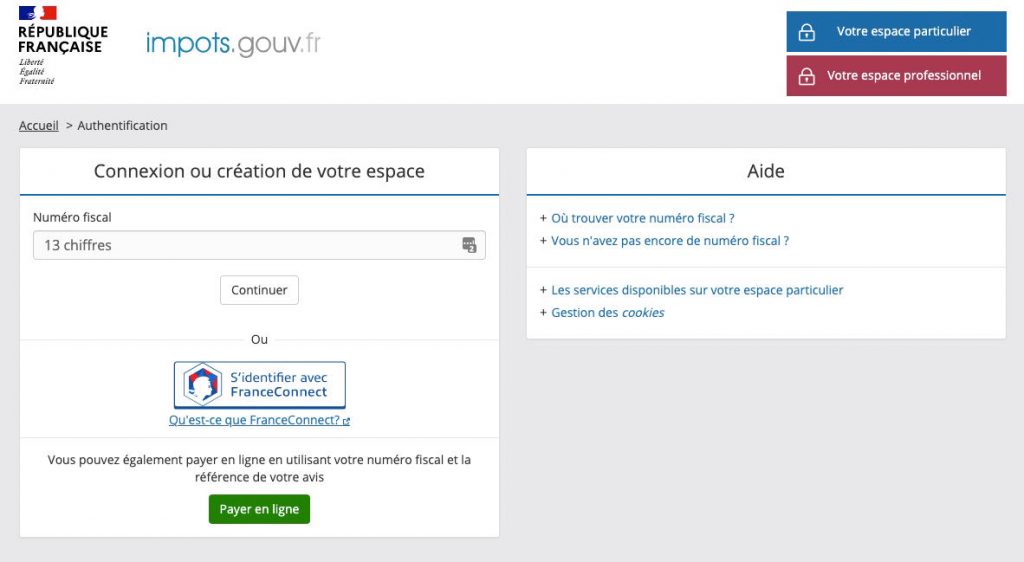

Afterwards, I realized that we could have found my number through the online portal. All completed tax returns are uploaded to this interface. Each spouse will have their own login credentials, but they both have access to the same joint documents.

The paper tax declaration that we submitted was digitized and uploaded. They also completed the form with my tax number. My husband could have easily logged into the portal and taken a look at the tax return, but we didn’t think to check!

From what I understand, once you have been assigned a French tax identification number, you can access the online tax portal by logging in with either your tax number or through France Connect.

Did this guide help you? Say thanks with a cup of coffee!

Contact Information

Contact the national tax office to get the most up-to-date information. This is a general number that you can call to get information about taxes:

0 809 401 401

Monday to Friday 8:30AM to 7:00PM

You can also try contacting the local tax office for individuals (as opposed to businesses), known as the SIP (Service des impôts des particuliers), for your city/town.

On this website, you’ll find a comprehensive list of all of these offices throughout France. If you use the search box under “RECHERCHER PAR”, you can do a search by postal code, town, department, or region. You’ll see all of the available contact information listed: address, phone number, and sometimes an email address.

The email addresses are mostly formatted the same way, so if you don’t see one listed, you can try this pattern:

sip.town@dgfip.finances.gouv.fr

Paris has a different email address for each arrondissement:

sip.paris-12e@dgfip.finances.gouv.fr

Related: Where to Get Help Filing Your French Tax Return

Official Tax Websites

Impots.gouv.fr—Official French tax website

English impots.gouv.fr—Official French tax website in English

Hey, Ellen !

I’ve been looking online, but haven’t had luck finding an answer. I’m 95% sure that I have a numéro fiscal from when I started working last year, but I’m not sure how to find it at this point. Do you know how I could find it?

Thanks for your help!

Sarah

Hey Sarah!

Did you try logging into the tax website? You can use FranceConnect to log in and you’ll see the tax number in the upper right corner if you’ve been assigned one.

Best,

Ellen

Hey Ellen,

This was helpful! I was just wondering if you checked the “filing for the first time” box in the beginning of the form 2042 when you applied because it is technically your first time even if it isn’t your husband’s first time?

Hi Achyuth! Glad this post was helpful. Yes, I believe that we checked that box the first time we declared together even though it wasn’t his first time. I hope your first French tax declaration has gone smoothly 🙂