This post may contain affiliate links, meaning that if you click and make a purchase, I may earn a commission at no additional cost to you. Read the full disclosure here.

This is a sponsored post written in collaboration with MyExpatTaxes. As always, all opinions are my own.

Last Updated: February 25, 2025

April tax filing season is not just for Americans located in the United States. Indeed, that infamous April 15th date looming ahead of us applies to Americans abroad as well. As an American citizen, even though I am living, working, and paying taxes in France, I still need to file US taxes, and you might need to as well!

Read on for tips and resources for US expats filing their taxes in the 2025 season. I’ll also share some of the particularities I’ve had to deal with while filing my US taxes abroad as an American married to a French citizen.

Please note that this blog post is for informational purposes only and does not constitute legal advice. If you have any questions or need personal guidance regarding your specific tax situation, contact a tax professional, like MyExpatTaxes.

Who’s required to file a US tax return?

You might be wondering why American expats need to file US taxes. While most countries impose taxes based solely on place of residency, the United States is one of few countries to tax based on nationality. If you are considered a US citizen, you may be required to file a tax return on your worldwide income even if you are living abroad and filing taxes in another country.

Most shockingly, this rule applies even if you’ve never lived on US soil. For Americans who move out of the country and start a family abroad, this is especially important to keep in mind, as they will likely be passing on citizenship to their children who will then potentially be responsible for filing obligations. People in this situation are considered “accidental Americans,” and it happens more frequently than you might think.

Expats who fail to file their US taxes and report their foreign earned income may be subject to penalties, including interest fees and criminal charges.

➡️ Note: Most states only require you to file a state return if you lived or worked in that state during the tax year in question. However, there are some states, like California, that won’t let you off the hook so easily! Check with your state to see if you are responsible for filing state taxes.

What is the federal tax filing threshold for Americans abroad?

In regards to the filing threshold, Americans living abroad are not treated any differently than Americans living in the United States.

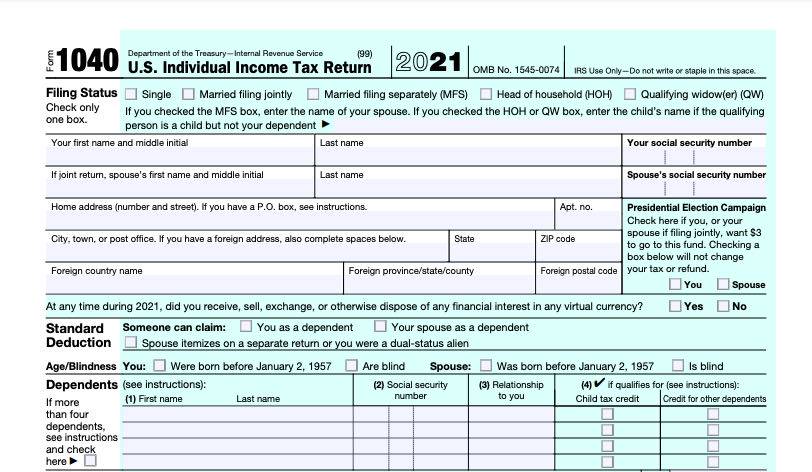

Based on your age and filing profile (single, married, head of household, etc), if you meet a certain filing threshold, you are required to file a US federal tax return. For example, if you are married and filing jointly and under the age of 65, the threshold is $29,200. On the other hand, if you are married and filing separately, the threshold is $5 (no, that’s not a typo!).

Refer to Table 1 in this Internal Revenue Service (IRS) publication for a full chart on the filing thresholds: https://www.irs.gov/pub/irs-pdf/p501.pdf

If your gross income is under the threshold, you are not required to file a tax return, but you can if you want. Personally, I’ve filed every year regardless of my income because I think it’s a good way to keep my paperwork in order.

How can you catch up on your filing?

Let’s say you were so busy enjoying your newfound life abroad that you forgot to file. I totally understand—Croissants have regularly distracted me from my responsibilities! Maybe you didn’t even realize that filing your US taxes was something that you needed to do.

You might be nervous about the consequences, but the IRS has set up a streamlined procedure to get caught up on your filing. This program was created to help eligible American taxpayers get fully compliant. Therefore, the process is penalty-free. If you’re feeling overwhelmed at the prospect of getting caught up on delinquent tax returns, consider using a software like MyExpatTaxes to guide you through it.

Will you actually need to pay any US taxes?

Having a filing requirement does not necessarily mean that you will need to pay taxes. Many countries have tax treaties with the United States. I am lucky to be living in France where there is a comprehensive tax treaty in place that even protects me from paying self-employment taxes to the United States. The French Embassy explains some of the main provisions of this treaty.

In order to avoid double taxation, US expats can also benefit from the Foreign Earned Income Exclusion (FEIE). For the 2024 tax year, you can exclude up to $126,500 of your foreign earnings. You’ll need to be able to claim Bona Fide Residency or use the Physical Presence Test in order to qualify.

In taking advantage of the FEIE and other exclusions and tax credits, most Americans will only need to pay taxes in their country of residence. Particularly in your first couple of years abroad, it can be advantageous to consult with a trustworthy tax professional to ensure that you’re maximizing your return according to your circumstances.

Related: French Income Taxes: 6 Things You Need to Know

What is the FBAR?

The FBAR (Report of Foreign Bank and Financial Accounts) is an annual report that is submitted separately from your federal tax return. It is due on April 15th, but there is an automatic extension to October 15th if you miss that deadline.

Any bank account outside of the United States is considered a foreign financial account. If you have a total of $10,000 or more across foreign bank accounts, at any point in the year, you need to declare all of your financial accounts and their balances. Keep an eye on your bank statements because you’ll need to file this form even if you passed the threshold for only a single day out of the year.

You can file your FBAR by paper or through the Financial Crimes Enforcement Network’s (FinCEN) BSA e-filing system.

➡️ Hot Tip: MyExpatTaxes is one of the only US expat tax softwares that allow you to file an FBAR.

When is the tax filing deadline for US expats?

For US citizens living in the United States, April 15th is the traditional tax filing deadline set by the IRS. However, this date changes if it conflicts with the weekend or a holiday. The filing deadline for 2024 Tax Return is April 15, 2025.

Additionally, this filing deadline is automatically extended by two months to June 16th for US citizens living abroad. (Normally, this would be June 15th, but this date is a Sunday.) There is nothing that you need to do in order to benefit from this extension. If you’re really in a bind as the filing due date approaches, you can request an extension to October 15, 2025 using Form 4868.

⚠️ Keep in mind that if you DO owe US taxes, you need to pay those taxes by April 15, 2025. Check out this year’s tax calendar for American expats in France.

How can you file your US taxes from abroad?

You have a few options when it comes to filing your US tax return while out of the country. There is always the option to completely prepare your return by yourself and file it with IRS Free File or Fillable Forms. Most free softwares that exist, like OLT, still require a great deal of independence in being able to input your own information.

If you need slightly more guidance, the next step would be to purchase a commercial software. Many softwares offer a paid add-on option where you get some extra assistance. Of course, the most expensive filing route would be to hire an accountant to help you every step of the way. Whatever you decide, be sure to choose a software or an accountant who specializes in expat taxes. They are not all created equal.

What if you’re married to a French citizen?

The IRS does allow for foreign spouses to get a social security number so that you can also declare their worldwide income in the United States. However, I have decided to decline this generous offer 😅 and will not be subjecting Jonathan to the American tax system.

As such, my French husband is considered a nonresident (NRA) spouse. I need to include him on my tax return, but I don’t need to report any of his income. When I file “Married Filing Separately,” since he does not have a US social security number, I need to write in “NRA.” Unfortunately, there are few electronic filing options that support writing “NRA” instead of a social security number.

A few years ago, I filed a paper tax return because I was not able to find a way to easily efile with Jonathan’s info. Since this was “unusual” activity from my past returns, the IRS checked up on me and I had to go through a process to verify my identity!

MyExpatTaxes

The following year, MyExpatTaxes invited me to try out their software. The interface is easy to use and their blog has tons of indispensable (free!) information with clear explanations. The cherry on top? They allow for efiling with an NRA spouse. Let’s hope I’ve put an end to phone calls from the Internal Revenue Service 😉

➡️ Get 10% off when you file with MyExpatTaxes using my discount code: EH10. This discount code is valid through December 15, 2025 on your 2024 tax return! You can use it whether you are a returning customer or filing for the first time with MyExpatTaxes. What are you waiting for?

Hi!! I’m just struggling on where to physically send the check to pay for my US taxes 🤣 They list a PO box but we’ll be using FedEx. Their website literally just sends us around in circles! There’s one page that lists 3 options for mailing from abroad but when we follow their links to try to figure out which one to use, it ends up back at the page that lists the PO box 🤯 Still hunting for this info… 🤷🏻♀️

Hi Diane,

The PO Box is the only address I’m aware of if you’re enclosing payment, as indicated here: https://www.irs.gov/filing/international-where-to-file-form-1040-addresses-for-taxpayers-and-tax-professionals

You’d think they’d make this part easier on us!

Omg! Last year, my accountant told me to file as single since (like yours) my husband doesn’t work in America or anything 😬 I’m a bit worried!

Did you have to provide any info about him when filing as NRA?

Hi Amber,

As I am not a tax professional and do not know enough about your particular situation, I cannot make a comment on the advice you were given. My understanding is that Married Filing Separately is not the only option for those of us living abroad with a foreign spouse. Head of Household is also an option, for example. I suggest you take a look at the IRS website and check out the resources I’ve linked throughout this article to make sure that everything is squared away as it should be!

For my situation (MFS), the only info I provide regarding my husband is that he exists and that he is an NRA.

Hope this helps. I wish filing our US taxes wasn’t so stressful!

Thanks for your reply! I will look into this more.. but good to know you didn’t have to provide any further info about him. Have a good weekend!