This post may contain affiliate links, meaning that if you click and make a purchase, I may earn a commission at no additional cost to you. Read the full disclosure here.

The idea of working for yourself in France can sound incredibly appealing—a flexible schedule, café meetings, and the charm of French life. But behind the romanticized image of freelancing abroad lies a very real set of challenges that every self-employed person in France must navigate. Here’s what it’s really like to be your own boss on French soil.

Note: The auto-entrepreneur status is the simplest business setup for independent contractors in France. Also known as a micro-entreprise, it comes with many advantages, so it’s often preferred among freelancers. This article is mainly based on self-employed individuals with this status.

Paying High Taxes & Social Charges

Les cotisations are social charges that everyone in France participates in. Social charges help finance public benefits like healthcare coverage and retirement. These contributions are calculated as a flat-rate percentage of your income, from the very first euro.

⚠️ Unlike salaried employees, freelancers have to coordinate their own mutuelle, top-up health insurance, which helps fill in the gaps in coverage in the public system .

In other words, regardless of how much you’re earning, the same percentage is charged. Different percentages are applied based on the type of business activity being conducted, such as providing services or selling products.

💡 Pro Tip: Eligible freelancers can benefit from a reduction in social charges through Acre.

To give you an idea, I provide services and currently pay 24.6% of my income toward social charges! Wow, Ellen, that’s a lot! Yes. Yes, it is. And they’re going up. AND we haven’t even talked about taxes yet…

Income taxes are paid in addition to the social contributions. Freelancers have an automatic abattement, or reduction in taxes. The standard abattement for freelance service providers is 34%, which means that I pay taxes on 66% of my income. The regular tax scale then applies based on my household. Bigger businesses that fall outside of the micro-entreprise setup itemize their expenses to lower their taxable income.

Related: French Income Taxes: Things You Need to Know

Instead of using the abattement, auto-entrepreneurs can opt for the versement forfaitaire libératoire (VFL). In this case, a low, flat percentage is charged on all income and paid along with social charges throughout the year. For most freelancers, this rate is 2.2%. If your total household income is above a certain threshold, you are not eligible to take advantage of this low tax rate.

For extra fun for everyone, there’s a surprise tax that many self-employed people forget about. This is because it doesn’t pop up for the first time until near the end of the calendar year in your second year of business. The CFE (cotisation foncière des entreprises) is calculated based on your income and place of business, even if you’re simply working from home.

Auto-entrepreneurs in France arguably enjoy a simplified tax structure, but the accumulated effect of social contributions and various taxes can be a hefty financial burden.

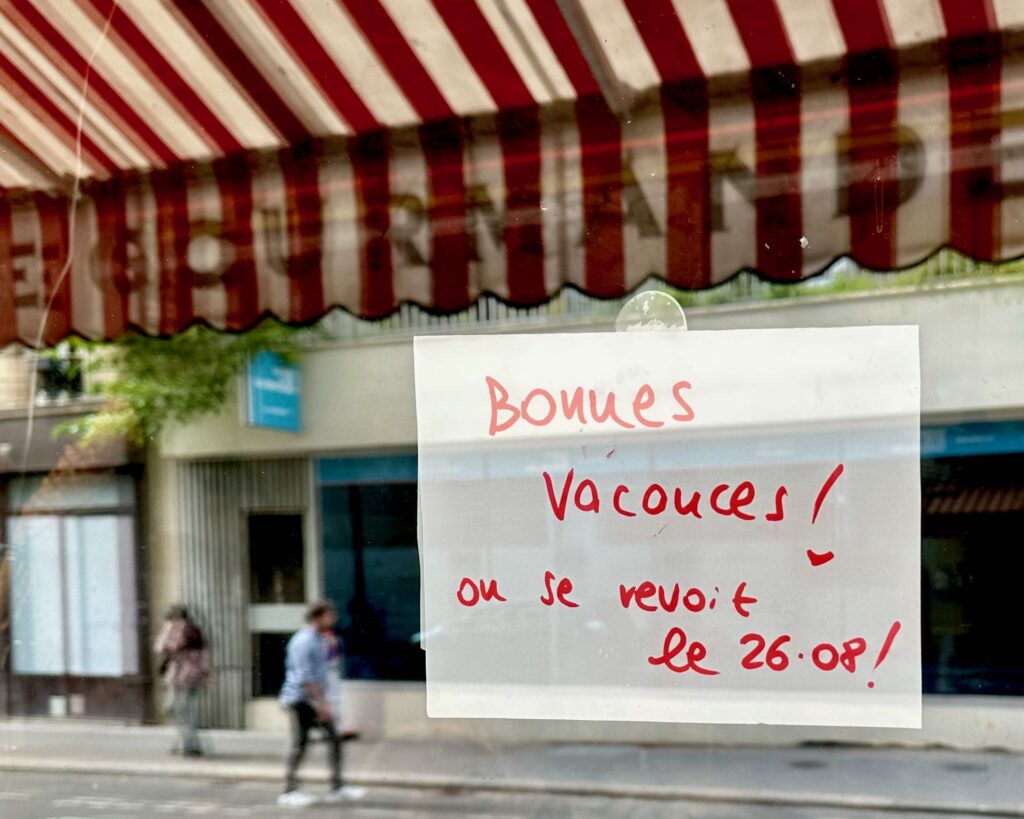

Watching Everyone Else Enjoy Time Off

France is known for having a lot of time off. Salaried workers in France enjoy five weeks of paid leave per year. Students have two weeks off from school every six weeks or so. Not to mention, there are a bunch of jours fériés (bank holidays) as well that “everyone” gets to enjoy. This year, the month of May has three bank holidays that all fall on Thursdays, which means that many people are taking Fridays off to faire le pont and have a few long weekends.

As a freelancer, unless you’ve mastered the art of passive income, the general rule is that if you’re not working, you’re not earning money. If you want to have time off for vacation, you have to wisely budget and plan for that. Even then, taking time off can be tricky depending on your clients and workload.

As someone who works with international clients, I’m often completely oblivious to holidays… until someone asks me what I’m doing that day! 😆 A couple of years ago, I worked on a marketing campaign for a French agency that asked for my deliverables to be emailed by Thanksgiving Day. I sent off that email stateside while a turkey roasted in the oven.

Of course, I would be remiss not to mention that freelancers are entitled to some financial aid when it comes to time off in France. For example, there is paid maternity leave as well as paid sick leave for freelancers. It’s not a lot of money, and there are prerequisites to qualify, but these are benefits that I’m truly grateful for!

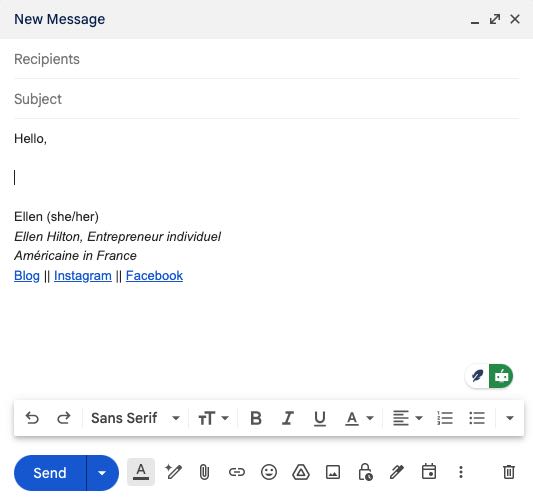

Keeping Track of Ever-Changing French Admin

“Arbitrary” and “unnecessarily complicated” are the first adjectives that come to mind when I think about the admin involved in working as a freelancer in France. Here are a few things I’ve had to navigate recently:

- Of all the paperwork I’ve handled in France, I think that updating my business address through inpi has been one of the most convoluted tasks. It was so arduous that the online request timed out by the time I got through the entire form, which was several pages.

- Since 2022, it’s been obligatory for all those working for themselves to include the designation entrepreneur individuel or the abbreviation EI after their name on official documents. This includes invoices, advertisements, and correspondence.

- In the very near future, electronic invoicing through an approved platform will be a requirement for most self-employed individuals. This is probably for the best since they keep adding to the list of notes that must be included on invoices. The mentions obligatoires take up so much room that I barely have any space left for the actual bill on my invoices.

Just because you’re working for yourself doesn’t mean you have to figure it all out on your own! Here are two Facebook groups that I find especially helpful for keeping up to date on changing regulations when it comes to working for yourself: Anglopreneurs and Ladies in Business in France. I also subscribe to La Micro by Flo’s newsletter, which is in French. He always knows the latest news and has incredibly clear guides on his blog.

Decoding the Acronyms

It may relate to bureaucracy, but I feel like wading through this alphabet soup of acronyms deserves a header of its own.

Here’s a list of acronyms related to working as a self-employed person in France, grouped by general themes:

- URSSAF, INPI, APE, SIP, SIRET, SIREN, ME, AE, EI—all related to business registration

- CA, BIC, BNC, TVA, CFE—income/turnover and taxes

- ACRE, ARCE, RSA—aids and benefits

- CIPAV—retirement funds

Inventing new acronyms is surely a favorite pastime of the French government. Some are disturbingly similar or cover similar things. It’s hard to keep them all straight!

Attempting to Rent an Apartment

Unsurprisingly, landlords prefer tenants with stable, fixed incomes so that they can be sure to receive their monthly rental payments. The ideal tenant in France has a permanent work contract, known as a CDI (contrat de travail à durée indéterminée).

Freelance workers are generally considered liabilities because they do not have traditional employment contracts. By the very nature of working as a freelancer, your employment can change suddenly and your income can fluctuate.

My French husband worked as a freelancer for many years. Despite his nationality, and even though he had secured regular clients and substantial contracts, it was much more difficult for him to rent an apartment in Paris as a self-employed person than as a salaried worker. The difficulties associated with renting an apartment due to working as a freelancer are a major drawback to this type of work.

Despite these challenges, could you imagine starting your own business and being self-employed in France?